tax loss harvesting rules

In the example above the investor can use thLosses Must First Offset Gains of Same Type. Last Updated July 20 2022 544 pm EDT.

What You Should Know About Tax Loss Harvesting

Tax-Loss Harvesting Rules 1.

.png)

. Federal government allows investors to. Some investment accounts like your 401k 403b or IRA are tax. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to.

Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue. But theres a silver lining. You can only do tax-loss harvesting in your taxable brokerage accounts and not in 401ks or IRAs.

Tax loss harvesting rules are necessary to be aware of as it does not allow investors the liberty to buy or sell stocks anytime based on the realized losses and profits. As with any tax-related topic there are rules and limitations. You defer that 15000 tax payment for seven years.

When done without regard for the clients bigger picture tax-loss harvesting is as likely to have a negative outcome for the investor as a positive one. And then when the tax comes due. Here are three things youll want to watch out for as you use this tax break.

Tax-loss harvesting rules to know You wont find any specific reference to tax-loss harvesting in the 45000 words the IRS devotes to investment income and expenses in. Three things to watch out for when harvesting a loss. The chance to turn losses into tax breaks as long as you follow the rules.

Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the. But basically youre able to take that 100000 gain which nets you 15000 in taxes. The strategy known as tax-loss harvesting allows you to sell declining.

There are some important rules to keep in mind with tax-loss harvesting. Per the IRSs netting. Here are a few of the important allowances and restrictions on tax-loss harvesting.

Of course the IRS has some. Another important consid See more. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

Your investments need to be in a taxable investment account. To do it you simply need to lock in a loss by selling the. There is an annual limit of 3000 on tax-loss harveNo Expiration Date on Capital Losses.

Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. TLH Annual Limit of 3000.

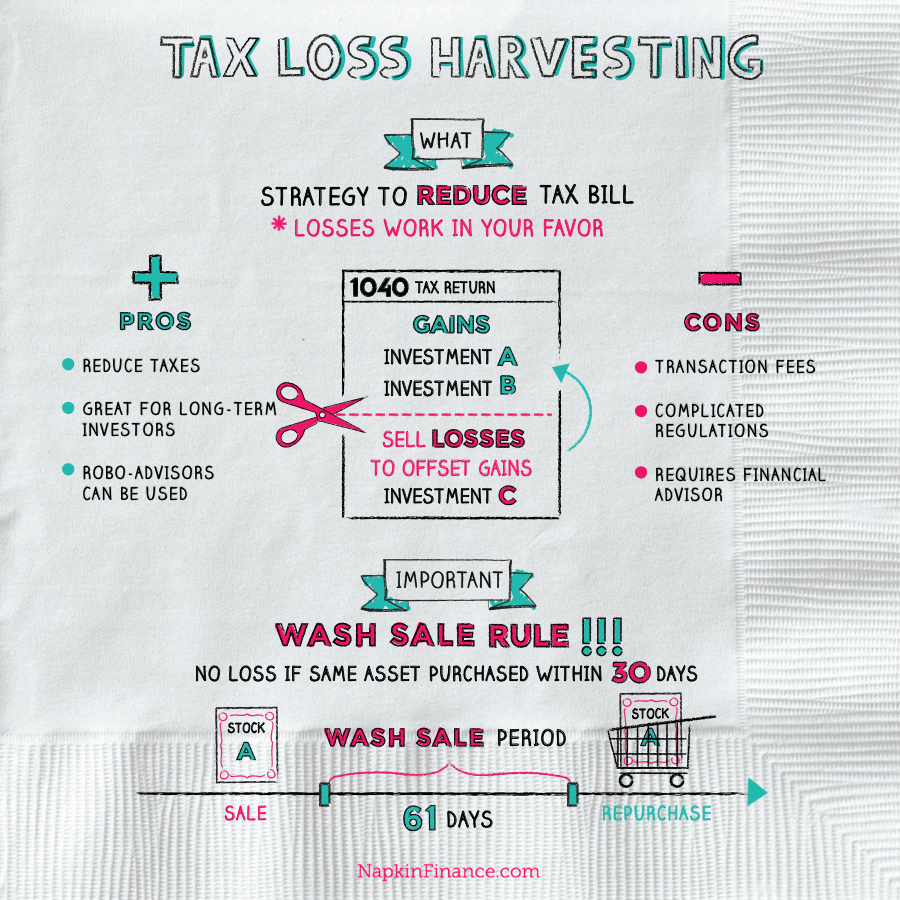

Taxlossharvesting Napkin Finance

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Year Round Tax Loss Harvesting Benefits Onebite

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting And Wash Sale Rules

What Is Tax Loss Harvesting Mission Wealth

Reduce Taxes With Tax Loss Harvesting

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Tax Loss Harvesting More Than A Year End Tax Strategy

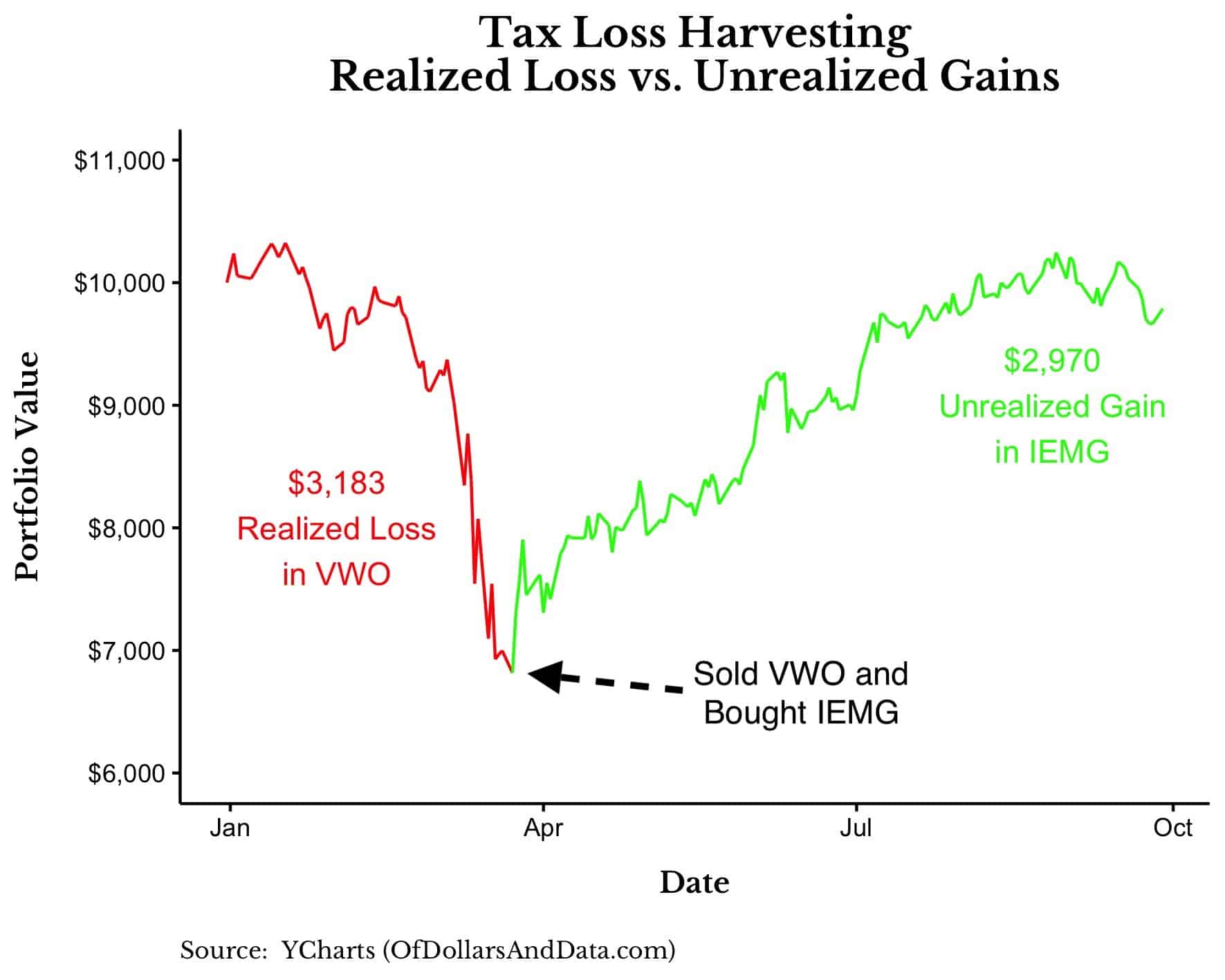

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Tax Loss Harvesting Napkin Finance

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Crypto Tax Loss Harvesting Investor S Guide Koinly

Tamarac Trading Tax Loss Harvesting Strategies Envestnet Tamarac